Laconia land deal buyer Robynne Alexander under investigation by state securities bureau

The Lakes Region Facility property in Laconia, N.H., on Tuesday, Aug. 24, 2021. Alan MacRae/New Hampshire Bulletin

| Published: 04-09-2024 12:49 PM |

This story was updated April 9, 2024, at 10:05 a.m. after two people Alexander identifies as team members said they consulted for her briefly and have no ongoing role in the project.

The state Bureau of Securities Regulation, an agency charged with protecting investors against fraud, is investigating Robynne Alexander, the state’s chosen buyer for a $21.5 million land deal in Laconia.

It’s the latest development in Alexander’s history of real estate problems that includes at least nine lawsuits from investors, three foreclosures, and unpaid taxes in multiple municipalities.

Anna Sventek, communications director for the Secretary of State’s Office, which houses the Bureau of Securities Regulation, confirmed the investigation in an email to the Bulletin late Friday. Sventek declined to say when the investigation began, describe its focus, or identify what prompted it.

It was unclear Monday how the investigation may affect the state’s plans to close its deal with Alexander, who after being granted multiple delays, must secure $21.5 million in cash by April 22. Alexander’s spokesperson, Scott Tranchemontagne, declined to comment on the investigation. He wrote in an email, “We are working diligently to secure the necessary funds to close on the Laconia property.”

The Bulletin had asked Sventek if her office had “received complaints from investors related to Robynne Alexander or her companies, which include Legacy at Laconia, HB9G, Gilf80 or Gilfeighty, Any Property Rehab, Infinite Equities, and Elm and Baker.”

Sventek replied: “The Bureau of Securities Regulation can confirm the existence of an ongoing investigation into Robynne Alexander. The bureau has no further comment at this time.”

State law defines securities broadly, to include limited liability companies. The bureau can impose civil or criminal penalties. In recent cases, penalties have included orders to cease activity and fines, according to its website.

Article continues after...

Yesterday's Most Read Articles

Hometown Heroes: Couple’s sunflower fields in Concord reconnects the community to farming

Hometown Heroes: Couple’s sunflower fields in Concord reconnects the community to farming

Boscawen resident takes issue with proposed town flag designs

Boscawen resident takes issue with proposed town flag designs

Skepticism turns to enthusiasm: Concord Police welcome new social worker

Skepticism turns to enthusiasm: Concord Police welcome new social worker

With new plan for multi-language learners, Concord School District shifts support for New American students

With new plan for multi-language learners, Concord School District shifts support for New American students

With Concord down to one movie theater, is there a future to cinema-going?

With Concord down to one movie theater, is there a future to cinema-going?

Opinion: The Concord School Board can restore trust with residents

Opinion: The Concord School Board can restore trust with residents

Prior enforcement actions have involved Ponzi schemes, individuals defrauding investors by misrepresenting their expertise; and the mishandling of “opportunity zone” tax deferment programs.

The Laconia property falls within an opportunity zone. Alexander and her team began offering opportunity zone investment opportunities this summer. The investors who have sued Alexander in superior court have alleged the money they invested in one project was moved to another without their knowledge.

The Consumer Protection and Antitrust Bureau within the Attorney General’s Office has not received complaints against Alexander, said spokesperson Michael Garrity.

The Bulletin has chronicled Alexander’s real estate problems since December 2022, two weeks before the Executive Council voted 3-2 to approve her $21.5 million offer, which was nearly twice what other bidders offered. More recently, Alexander filed for Chapter 13 bankruptcy protection in August, indicating on her filing that she owed more than $1 million to at least one creditor and had less than $1 million in assets. The federal bankruptcy court in New Hampshire dismissed the case in December because Alexander did not file required documents.

Those accounts have not raised concerns for the Department of Administrative Services, which is overseeing the sale, or Gov. Chris Sununu, who sought a law change to sell the property outside the typical state review process. Charlie Arlinghaus, commissioner of administrative services, has said the state has confidence in Alexander’s partners on this project.

Arlinghaus said Monday the April 22 deadline will not change. He said he did not know enough about the investigation to say how it may affect the sale. Sununu’s office did not respond to a request for comment Monday.

Over the last few months, Alexander has appeared on YouTube shows, talking about her prior real estate successes and her vision for the Laconia site.

In September, she told Leo Kanell on his 7 Figures Funding podcast that the Laconia development would be the world’s first “barrier free” luxury resort where people with disabilities could access every space. Plans called for hot air balloons and pontoon boat rides, she said.

“It’s the only protected class that any one of us can join from a trip on the surface to an accident,” Alexander said. “And there’s a lot of people that are traveling and want to travel but can’t because there’s no really good place for them to go.”

Kanell praised Alexander’s prior successes, seemingly unaware many in New Hampshire have led to lawsuits and foreclosures, and asked Alexander to share her wisdom – and an email address for anyone interested in investing.

“The only reason I have this much wisdom is because I’ve made every single mistake in the book,” Alexander told Kanell, who did not return a message Friday. “Don’t be afraid to invest, guys, just know what you’re doing … and partner with people that are educated, that have a proven track record, and that have your best interest at heart.”

According to the “Legacy at Laconia” website for the proposed mixed-use development in Laconia, Alexander’s “team” includes Tom Dolan, a licensed real estate broker in Massachusetts and New York with hotel development experience, and Yair Tilson, founder and CEO at Kay Finance, an international real estate capital advisory firm.

The website is aimed at investors interested in opportunity zone financing.

Dolan and Tilson told the Bulletin they were unaware they were identified on the website as members of the team. Both said they had done consulting work with Alexander but have no ongoing relationship with the project.

“I have not been directly involved in this project for a very long time,” Tilson wrote in an email. “We were hired a number of years ago, as a mortgage broker to help secure construction financing for the project.”

Laconia city officials began raising concerns about Alexander and her ability to pull off the Laconia project, which far exceeds anything she’s done, long before the Executive Council voted to accept her offer. The city and state disagreed over how thoroughly she and her partners had been vetted.

“This is not a fly-by-night organization,” Sununu told the council two weeks before it was asked to approve a deal with Alexander. “These folks have other projects, and again, all of this was reviewed by a technical committee before bringing it up here. And reviewed by the city of Laconia.”

Laconia Mayor Andrew Hosmer recalled Monday getting a call from Sununu around that time. “In a conversation with me, he felt that I and the city were being insolent and, in his mind, thoroughly incompetent in how we were weighing in on the selection of this potential developer.”

He said the city remained optimistic despite its concerns about Alexander’s real estate problems, and has been committed to the project, which is slated to bring 1,260 housing units, a 200-room hotel, recreational space, and retail sites. The city worked with Sen. Tim Lang, a Sanbornton Republican, to secure $3 million in state funding to enhance its water and sewer systems to accommodate Alexander’s proposal.

Learning Monday that the Bureau of Securities Regulation is investigating Alexander exacerbated Hosmer’s concerns.

“I want to be clear,” he said. “I think this developer has surrounded herself with many competent professionals who have excellent reputations. I’m just not sure it’s enough at this point to overcome (Alexander’s) questionable decisions, foreclosures, and now this very troubling investigation. It seems like a long shot now that they will be able to secure their financing with this investigation pending.”

Executive Councilor Ted Gatsas was one of the two councilors to vote against selling the land to Alexander in 2022 after learning she had been sued, had a history of tax liens, and was three years behind on a mixed-use project in his city of Manchester. He has continued to raise doubts about her, especially after she began requesting to delay the closing.

Gatsas said Monday he thinks the state’s deal with Alexander will fall through independent of the investigation by the Bureau of Securities Regulation.

“In your wildest dreams, do you think she’s going to be able to come up with the money?” Gatsas said. “That’s impossible. She’s not going to do it. We’re going to be going out looking for a new buyer because this person doesn’t qualify.”

Voice of the Pride: Merrimack Valley sophomore Nick Gelinas never misses a game

Voice of the Pride: Merrimack Valley sophomore Nick Gelinas never misses a game With less than three months left, Concord Casino hasn’t found a buyer

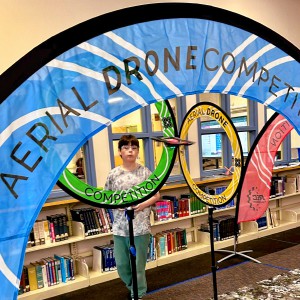

With less than three months left, Concord Casino hasn’t found a buyer Kearsarge Middle School drone team headed to West Virginia competition

Kearsarge Middle School drone team headed to West Virginia competition Phenix Hall, Christ the King food pantry, rail trail on Concord planning board’s agenda

Phenix Hall, Christ the King food pantry, rail trail on Concord planning board’s agenda