Climate disasters elsewhere can raise home insurance rates here

A sanitation worker collects trash at the last customer before a downed tree blocking the road, Friday, April 5, 2024, in Derry, N.H. Charles Krupa/AP file photo

| Published: 04-12-2024 1:00 PM |

By the standards of the world’s increasing climate disasters – the tornadoes, wildfires and deadly heat waves that fill headlines every week – the back-to-back snowstorms that just clobbered New Hampshire’s power grid weren’t too bad.

But don’t get complacent. Even if we dodge the worst climate effects of a changing world, we can’t dodge the financial effects.

“In New Hampshire we like to think we are the captains of our own destiny … The reality is the insurance industry is all interconnected, nationwide and in some respects worldwide,” said D.J. Bettencourt, commissioner of the New Hampshire Department of Insurance, responding to questions about home and property insurance. “Hurricanes in Florida, wildfires in California or crazy winter weather events in the Rocky Mountains, it all has an impact on the insurance industry. There are ripple effects felt in every step.”

The National Oceanographic and Atmospheric Administration says the U.S. had 23 climate disasters in 2023 which caused at least a billion dollars worth of damage, including the February ice storm in the Northeast. That was the most ever in one year, beating the previous record of 22 such disasters. The long-term average is 9 per year, NOAA said.

“It’s undeniable that across the country we are seeing catastrophic weather events, more frequently and more severe,” Bettencourt said. “That has a financial impact, and we have to ensure companies are carrying adequate reserves to cover claims.”

He said the National Association of Insurance Commissioners is holding discussions “on climate resilience in insurance and what steps to take.”

In parts of the country the effect on property insurance due to the climate emergency is dire. In south Florida, repeated storms have led insurance companies to jack up their rates – home insurance in that state is said to cost four times the national average – or leave the market entirely. There is talk that some areas of the country, including regions susceptible to huge wildfires, will become virtually un-insurable because the risk of damage is so great.

New Hampshire is far from that situation, of course. More than 100 companies offer some type of home or property insurance here and no firms have indicated they want to leave because claims exceed income.

Article continues after...

Yesterday's Most Read Articles

Hometown Heroes: Couple’s sunflower fields in Concord reconnects the community to farming

Hometown Heroes: Couple’s sunflower fields in Concord reconnects the community to farming

Boscawen resident takes issue with proposed town flag designs

Boscawen resident takes issue with proposed town flag designs

Skepticism turns to enthusiasm: Concord Police welcome new social worker

Skepticism turns to enthusiasm: Concord Police welcome new social worker

With new plan for multi-language learners, Concord School District shifts support for New American students

With new plan for multi-language learners, Concord School District shifts support for New American students

With Concord down to one movie theater, is there a future to cinema-going?

With Concord down to one movie theater, is there a future to cinema-going?

Opinion: The Concord School Board can restore trust with residents

Opinion: The Concord School Board can restore trust with residents

But climate damage elsewhere still affects our rates, mostly through what is known as re-insurance. That’s a global industry in which insurance companies buy their own insurance to protect themselves against a big claim event, such as a hurricane.

“What’s happening is those large re-insurance companies, which tend to be international … they’re tightening up their selection for what properties they want to ensure. When companies in New Hampshire go to seek re-insurance, it’s more expensive to them,” said Deputy Commissioner Keith Hyhan.

Property insurance in New Hampshire is only loosely regulated and the state has limited control over companies.

“I have no legal authority to disallow rate increases simply because I don’t like them,” said Bettencourt. The only control they have is determining that rates are “actuarily justified” – that is, determined by an actuary, the statistical analysis of insurance risk, as necessary to keep the company in business. Rising costs from claims elsewhere can be part of the actuarial justification for higher rates here.

Companies can’t deny coverage based purely on location, such as refusing to insure any property within a certain distance of the coast due to rising sea levels. But they can raise rates due to perceived risk from a location.

One of the biggest property risks in New Hampshire in recent years is flooding caused by heavy rains. The warming atmosphere can hold more water which makes it more likely that a deluge will happen, as New Hampshire and Vermont have seen in recent years.

Home insurance does not cover damages from flooding, Bettencourt pointed out. A separate federal flood insurance program exists and the Insurance Department recommends that all homeowners, not just those in well-known floodplains, should consider buying flood protection because of the increased risk.

Even better, he said, is to limit damage in the first place and to use that to your advantage when buying insurance.

“Homeowners should seriously consider risk mitigation factors. Take a careful look at your property, things within the home and particularly the exterior, that need attention, because those steps will factor in favorably to underwriters,” Bettencourt said. “Shop that quote around, make sure you’re getting the best bang for your buck.”

Voice of the Pride: Merrimack Valley sophomore Nick Gelinas never misses a game

Voice of the Pride: Merrimack Valley sophomore Nick Gelinas never misses a game With less than three months left, Concord Casino hasn’t found a buyer

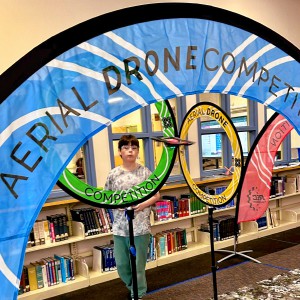

With less than three months left, Concord Casino hasn’t found a buyer Kearsarge Middle School drone team headed to West Virginia competition

Kearsarge Middle School drone team headed to West Virginia competition Phenix Hall, Christ the King food pantry, rail trail on Concord planning board’s agenda

Phenix Hall, Christ the King food pantry, rail trail on Concord planning board’s agenda