Hassan discusses child tax credit 'lifeline' amid efforts to expand it

State and local leaders met with U.S. Sen. Maggie Hassan, D-N.H., center left, in Keene Monday and discussed a federal bill that would expand the child tax credit for families with qualifying children. Christopher Cartwright—Keene Sentinel

| Published: 03-26-2024 11:30 AM |

Local and state leaders involved in nonprofit and advocacy work spoke to U.S. Sen. Maggie Hassan in Keene Monday about residents' struggles to afford housing and child care, adding that a proposed child tax credit expansion would help the problem.

U.S. House of Representatives Bill 7024, the Tax Relief for American Families and Workers Act of 2024, is sponsored by U.S. Rep. Jason Smith, R-Mo., and passed the House 357-70 on Jan. 31. Among other things, Hassan, D-N.H., said it would expand the child tax credit for families with qualifying children.

“I have been working in the Senate to try to find this bipartisan path forward to get this tax package over the finish line, and one of the major pieces in this tax package is the child tax credit expansion,” she said, adding that the bill would expand the low-income housing tax credit as well. “… [The child tax credit] really does serve as a lifeline here in New Hampshire and all across the country for families who are struggling to make ends meet.”

According to The Hill, the current child tax credit is $2,000 although not all is refundable. The bill would raise the refundable amount to $1,800 in 2023, $1,900 in 2024, and $2,000 in 2025, its text states. And a Feb. 21 news release by the U.S. Internal Revenue Service says that if the bill passes, the department will automatically apply it to people who already filed.

A child dependent must meet several qualifications for their family to be eligible for the credit. To receive the full amount, a parent's income must not exceed $200,000 or $400,000 for a joint filing.

In 2021, the American Rescue Plan Act expanded the child tax credit that year to $3,000 for qualifying children between 6 and 17 and $3,600 for qualifying children under 6, according to the IRS.

During Monday's discussion at Home Healthcare, Hospice and Community Services on Marlboro Street, Hassan explained the bill and asked about what problems, especially related to child care, state residents face.

Melissa Gallagher, executive director of the Grapevine Family and Community Resource Center in Antrim, said she had seen the child tax credit’s help during the pandemic.

Article continues after...

Yesterday's Most Read Articles

“Anecdotally, what we were noticing was a marked drop in people who were coming to us for help,” she said. “And I don’t think that’s a coincidence.”

Penny Vaine, the head of Healthy Starts at Home Healthcare, Hospice and Community Services, said families are facing similar problems throughout the region.

“Families are really struggling,” she said. “…The challenges are around affordable housing, a lack of transportation and child care.”

Hassan asked MacKenzie Nicholson, the senior director of Moms Rising NH, about the difficulties parents experience and how the tax credit expansion might help.

“I know the child tax credit expansion would be helpful because we saw it happen … when we temporarily expanded it during the pandemic,” Nicholson said. “… What we hear from moms now is that … child care is a huge struggle.”

She said the combination of a lack of child care options and having children with complex needs, disabilities and mental health issues puts mothers “in a bind.”

“Moms are making really tough decisions about whether they leave the workplace to stay back and care for their kids,” she said, adding that the closure of a Seacoast region child care center had a “huge ripple effect.”

Heather Bell, co-owner and vice president of Electronic Imaging Materials in Keene, elaborated on the economic aspects of those ripple effects.

“We rely on every employee,” she said. “…Even a small amount, such as the child … tax credit, does provide some resiliency to those employees. It insulates them from life events such as a car breaking down or unexpected bill.”

Those life events could lead to employees missing work or potentially dropping out of the workforce, she noted.

“If I have an employee drop out of the workforce or even just out for a few days, I have a machine go down. I have customer orders that don’t ship,” she said. “That has a very real effect on a small business.”

And, she pointed out, the children growing up in the Monadnock Region affected by child tax credit policies are her company’s future interns or employees.

Liz LaRose, the president of Monadnock United Way in Keene, added that those life events due to a family's unstable economic condition have a pronounced effect on kids.

“When families can’t make ends meet … there’s stress in the home,” she said. “… And when you have that stress in the home, that affects children’s ability to learn; it affects their ability for their future.”

Nicholson also pointed to a 2024 care report card recently released by the Century Foundation, a progressive think tank. The report graded each state on “supportive family policies and worker rights and protections, such as paid sick and paid family leave, pregnant worker fairness, and the domestic worker bill of rights,” the organization’s website states. It gave New Hampshire a D, ranking it 31st in the nation, with Alabama lowest and Oregon highest.

“There are a lot of things that we could do better to bring our caregivers some relief, including the child tax credit, but also things like comprehensive paid family leave,” Nicholson said. “And also … student loan debt relief.”

Besides discussing the problems families face, Hassan also asked Amanda Sears, the director of the N.H. Campaign for a Family Friendly Economy, about ways to build support for the bill to get it passed.

“It was 357-70. I mean, that’s huge in this day and age, to find something that that many House members can get around and pass,” Sears said.

Sears called blocks to the bill's passing in the Senate “political gamesmanship” and said families that would benefit from the child tax credit should share their stories.

“It helps them to pay for food. It’ll help them to pay for housing,” she said. “… We need to share those stories and say, 'This is what that means' ... we should all demand that a good bill gets passed.”

Voice of the Pride: Merrimack Valley sophomore Nick Gelinas never misses a game

Voice of the Pride: Merrimack Valley sophomore Nick Gelinas never misses a game With less than three months left, Concord Casino hasn’t found a buyer

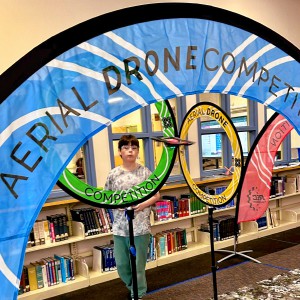

With less than three months left, Concord Casino hasn’t found a buyer Kearsarge Middle School drone team headed to West Virginia competition

Kearsarge Middle School drone team headed to West Virginia competition Phenix Hall, Christ the King food pantry, rail trail on Concord planning board’s agenda

Phenix Hall, Christ the King food pantry, rail trail on Concord planning board’s agenda