Latest News

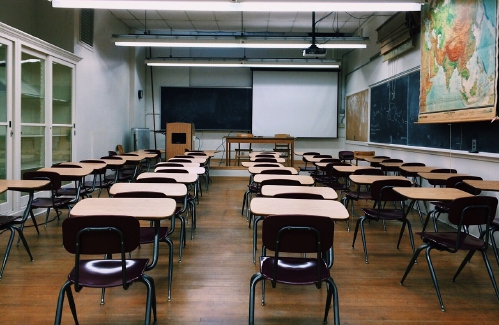

College due process rights at issue in NH bill

College due process rights at issue in NH bill

Opinion: Inherited hatred and how to stop it

Opinion: Inherited hatred and how to stop it

Concord fights stubborn brush fire along bank of Merrimack River

The Concord Fire Department spent Wednesday morning fighting a stubborn brush fire burning on a steep bank between the Merrimack River and the rail line just south of Sewalls Falls Road.“We think it had been smoldering for a couple of days,” said...

Construction of housing project in former Church to begin with parking dispute in the rearview

Construction can now begin on a project to transform the former First Congregational Church on North Main Street into housing after new plans, updated to reflect an agreement between developers and the neighboring Greater Islamic Society of Concord,...

Most Read

N.H. Educators voice overwhelming concerns over State Board of Education’s proposals on minimum standards for public schools

N.H. Educators voice overwhelming concerns over State Board of Education’s proposals on minimum standards for public schools

“It’s beautiful” – Eight people experiencing homelessness to move into Pleasant Street apartments

“It’s beautiful” – Eight people experiencing homelessness to move into Pleasant Street apartments

Voice of the Pride: Merrimack Valley sophomore Nick Gelinas never misses a game

Voice of the Pride: Merrimack Valley sophomore Nick Gelinas never misses a game

Matt Fisk will serve as next principal of Bow High School

Matt Fisk will serve as next principal of Bow High School

Former Concord firefighter sues city, claiming years of homophobic sexual harassment, retaliation

Former Concord firefighter sues city, claiming years of homophobic sexual harassment, retaliation

A trans teacher asked students about pronouns. Then the education commissioner found out.

A trans teacher asked students about pronouns. Then the education commissioner found out.

Editors Picks

What’s in a name? Ask an Epsom Yeaton.

What’s in a name? Ask an Epsom Yeaton.

Downtown cobbler breathes life into tired shoes, the environmentally friendly way

Downtown cobbler breathes life into tired shoes, the environmentally friendly way

People of color incarcerated at higher rates in New Hampshire, but data is limited

People of color incarcerated at higher rates in New Hampshire, but data is limited

Former Concord firefighter sues city, claiming years of homophobic sexual harassment, retaliation

Former Concord firefighter sues city, claiming years of homophobic sexual harassment, retaliation

Sports

High schools: Bow’s Kelly lifts Falcon softball to victory in walk-off, more Monday results, plus Saturday’s track meets

SoftballBow 5, Campbell 4Key players: Bow – Maddy Oppold (2-for-4), Ella Roos (3-for-4), Taylor Ouellette (2-for-4, 2 RBI), Emma Kelly (1-for-4, walk-off single), Lilly Wright (1-for-3, 2-run HR), Caly Poitras (4 IP, 7 H, 1 BB), Taylor Ouellette (3...

Patriots’ draft approach likely to be different in post-Belichick era

Patriots’ draft approach likely to be different in post-Belichick era

High schools: Weekend results

High schools: Weekend results

Opinion

Opinion: This stinks, but if you don’t speak up it’s going to reek

Celeste Clark is the executive director of Raymond Coalition For Youth. Think it’s not your issue so you don’t need to pay attention? Do you think, well I don’t use it so I really don’t care? Or, are you just plain sick of hearing about marijuana...

Opinion: The problem with Ukraine

Opinion: The problem with Ukraine

Opinion: This Earth Day, help keep local land clean and healthy

Opinion: This Earth Day, help keep local land clean and healthy

Opinion: Adopting the right 306 Rules

Opinion: Adopting the right 306 Rules

Politics

Sununu says he’ll support Trump even if he’s convicted

As jury selection begins this week in the hush-money trial of former President Donald Trump, New Hampshire Gov. Chris Sununu says he doesn’t believe many voters view Trump’s criminal indictments, his actions on Jan. 6, 2021, or his election denialism...

NH mayors want more help from state on homelessness prevention funds

NH mayors want more help from state on homelessness prevention funds

Two democrats with parallel views run for same State Senate seat

Two democrats with parallel views run for same State Senate seat

House passes bill removing exceptions to state voter ID law

House passes bill removing exceptions to state voter ID law

League of Women Voters suing over AI robocalls sent in NH

League of Women Voters suing over AI robocalls sent in NH

Arts & Life

Community Players of Concord present newest adaptation of Pride and Prejudice

“Not Your Grandmother’s Jane Austen…”Bold, surprising, boisterous, and timely, this Pride and Prejudice for a new era explores the absurdities and thrills of finding your perfect (or imperfect) match in life.The outspoken Lizzy Bennet is determined to...

Vintage Views: From darkness to light

Vintage Views: From darkness to light

From the farm: Spring brings calves, beautiful calves

From the farm: Spring brings calves, beautiful calves

Obituaries

Dennis Michael Schwab

Dennis Michael Schwab

Manchester, NH - It is with great sorrow that we announce the passing of Dennis Michael Schwab. He passed away on April 6th, 2024, after a period of failing health. He was 51 years old. With great dignity, Michael was very thankful to b... remainder of obit for Dennis Michael Schwab

Jay T. Sweeney

Jay T. Sweeney

Lyman, ME - Jay T. Sweeney, 64, of Lyman Maine, Passed away unexpectedly on Tuesday, February 20, 2024. He was born in Concord, NH on October 13, 1959, son of John and Donna Cozzi, Sweeney. He graduated from Concord High school, Class ... remainder of obit for Jay T. Sweeney

Patrick J. Pat" Lane

Patrick J. Pat" Lane

Patrick J. "Packin' Pat" Lane Concord , NH - Patrick Joseph Lane of Concord NH passed away suddenly in his home on April 8th. He was born in Seattle Washington October 8,1959. The son of Leo T. Lane and Blanche (Renshaw) Lane, the third... remainder of obit for Patrick J. Pat" Lane

Lisa Marie Cheney

Lisa Marie Cheney

Lisa Marie (Jameson) Cheney Boscawen, NH - Lisa Marie (Jameson) Cheney, 56 of Boscawen NH, passed away peacefully April 17, 2024 at Granite VNA Hospice House with family by her side. Born in Concord, NH on April 20, 1967, Lisa was the da... remainder of obit for Lisa Marie Cheney

Big drop in tuition and aid is boosting Colby-Sawyer

Big drop in tuition and aid is boosting Colby-Sawyer

Concord police ask for help in identifying person of interest in incidents of cars being keyed during Republican Party event

Concord police ask for help in identifying person of interest in incidents of cars being keyed during Republican Party event

High schools: Coe-Brown softball wins 5th straight, Concord’s McDonald pitches first varsity win, Tide’s Doherty scores 100th career point

High schools: Coe-Brown softball wins 5th straight, Concord’s McDonald pitches first varsity win, Tide’s Doherty scores 100th career point

At House hearing, some argue proposed transgender sports ban would violate anti-discrimination law

At House hearing, some argue proposed transgender sports ban would violate anti-discrimination law

Committee approves bill allowing host communities to join charitable gaming

Committee approves bill allowing host communities to join charitable gaming

Charities will not have to pay rent to casinos under new law

Charities will not have to pay rent to casinos under new law

Gallery: Forty-mile gravel bicycle race draws racers from all over the region

Gallery: Forty-mile gravel bicycle race draws racers from all over the region Wednesday’s high schools: Fancher’s 2-run blast leads Concord baseball to victory; plus more baseball, softball, lax and tennis results

Wednesday’s high schools: Fancher’s 2-run blast leads Concord baseball to victory; plus more baseball, softball, lax and tennis results Opinion: Student power: Confronting collaborators and cowards at home and abroad

Opinion: Student power: Confronting collaborators and cowards at home and abroad Concord Monitor editor Mike Pride’s final book explores the lives, works of Northern New England poets

Concord Monitor editor Mike Pride’s final book explores the lives, works of Northern New England poets Active Aging: John Burke of Peterborough celebrated his 81st birthday with 81 hikes up Pack Monadnock

Active Aging: John Burke of Peterborough celebrated his 81st birthday with 81 hikes up Pack Monadnock