‘Bittersweet’: The Post on Main Street closes Friday

If you ask Joe Kwasnik and Bill Judd how long they’ve known each other, their answer starts with an “Oh gosh…,” a hand to the chin and a pause.

Messy parking around Concord’s bus terminal won’t get less messy any time soon

There’s one lesson to be learned from what is occasionally the most chaotic parking area in Concord: Sometimes it’s better to hand over your keys.

Most Read

Editors Picks

The Monitor’s guide to the New Hampshire legislature

The Monitor’s guide to the New Hampshire legislature

One year after UNH protest, new police body camera footage casts doubt on assault charges against students

One year after UNH protest, new police body camera footage casts doubt on assault charges against students

‘It’s always there’: 50 years after Vietnam War’s end, a Concord veteran recalls his work to honor those who fought

‘It’s always there’: 50 years after Vietnam War’s end, a Concord veteran recalls his work to honor those who fought

‘We honor your death’ – Arranging services for those who die while homeless in Concord

‘We honor your death’ – Arranging services for those who die while homeless in Concord

Sports

Track & field: Belmont’s Lacasse, Takantjas win four events each to lead Red Raiders to Wilderness League Championship title

With one week to go until the NHIAA track and field division championships, the Belmont girls’ team showed its a favorite for the crown by winning the 23-team Wilderness League Championship at Newfound Regional High School on Saturday.

Opinion

Opinion: How dark can it get?

Jonathan P. Baird lives in Wilmot.

Opinion: Unfair taxes, unfair schools: The New Hampshire way

Opinion: Unfair taxes, unfair schools: The New Hampshire way

Opinion: In the fight to stop sexual violence, can polio hold the solutions?

Opinion: In the fight to stop sexual violence, can polio hold the solutions?

Opinion: Where are the permanent solutions for a more stable budget?

Opinion: Where are the permanent solutions for a more stable budget?

Opinion: My memories of Vietnam 50 years later

Opinion: My memories of Vietnam 50 years later

Your Daily Puzzles

An approachable redesign to a classic. Explore our "hints."

A quick daily flip. Finally, someone cracked the code on digital jigsaw puzzles.

Chess but with chaos: Every day is a unique, wacky board.

Word search but as a strategy game. Clearing the board feels really good.

Align the letters in just the right way to spell a word. And then more words.

Politics

New Hampshire school phone ban could be among strictest in the country

When Gov. Kelly Ayotte called on the state legislature to pass a school phone ban in January, the pivotal question wasn’t whether the widely popular policy would pass but how far it would go.

Sununu decides he won’t run for Senate despite praise from Trump

Sununu decides he won’t run for Senate despite praise from Trump

Arts & Life

Artist Spotlight: Brittany Batchelder

With creativity abounding in the community around us, The Concord Insider, in collaboration with Concord Arts Market, highlights local artists on a regular basis.

Bowling for a cause: Angelman Syndrome Fundraiser coming to Boutwell’s

Bowling for a cause: Angelman Syndrome Fundraiser coming to Boutwell’s

Beautify Allenstown hosting community cleanup day

Beautify Allenstown hosting community cleanup day

Obituaries

Gary G. Brassard

Gary G. Brassard

Franklin, NH - Gary G. Brassard, 73 of Franklin, NH left the planet on May 20, 2025. He was predeceased by his parents Amedee "Mickey" Brassard and Frances (Whitehead) Brassard. He is survived by his brother Frank A. Brassard and his wi... remainder of obit for Gary G. Brassard

Ruth K. Sargent

Ruth K. Sargent

Concord, NH - Ruth K. Sargent, 79, of Concord, formerly of Allenstown, passed away peacefully surrounded by her loving family on May 23, 2025. Born in Exeter, Ruth was the daughter of the late Dorothy May (Cowdrey) Lagor. She was ra... remainder of obit for Ruth K. Sargent

Michael Cavic

Michael Cavic

Meredith, NH - Michael Cavic, 89, beloved father, grandfather, and great-grandfather, passed away peacefully on December 18, 2024, at the age of 89. Born on May 13, 1935, in Bedford, Massachusetts, Michael lived a life filled with love,... remainder of obit for Michael Cavic

Albert R. Hagen

Albert R. Hagen

Concord, NH - Albert R. Hagen, age 97, of Cabernet Drive, Concord, NH, passed away peacefully with his family by his side at his home on Monday, May 26th, 2025. Born in Braintree, MA, the son of the late Albert R. and Umbelina (Govo... remainder of obit for Albert R. Hagen

High schools: Bow girls’ tennis advances in tourney, Stark baseball beats MV, Kearsarge softball wins first games of the season; Wednesday’s results

High schools: Bow girls’ tennis advances in tourney, Stark baseball beats MV, Kearsarge softball wins first games of the season; Wednesday’s results

Historic former Boscawen library building on sale – again

Historic former Boscawen library building on sale – again

There has been rain on two-thirds of the days in May, and more on the way

There has been rain on two-thirds of the days in May, and more on the way

Boys’ Lacrosse: Bean reaches milestone in Coe-Brown win over BowBears eat Falcons in heavy hitters matchup, 13-3

Boys’ Lacrosse: Bean reaches milestone in Coe-Brown win over BowBears eat Falcons in heavy hitters matchup, 13-3

High schools: Hillsboro-Deering sweeps Hopkinton; Tuesday’s baseball, softball, lacrosse and tournament tennis

High schools: Hillsboro-Deering sweeps Hopkinton; Tuesday’s baseball, softball, lacrosse and tournament tennis

Jesse Sullivan pleads guilty to second-degree murder of half-brother, Zackary

Jesse Sullivan pleads guilty to second-degree murder of half-brother, Zackary

Athlete of the Week: Emma Pelletier, Concord High School

Athlete of the Week: Emma Pelletier, Concord High School

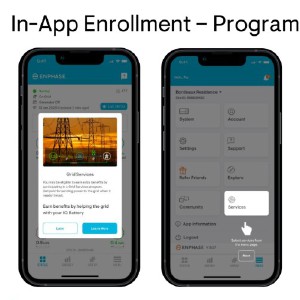

Granite Geek: Take advantage of living on the edge of the grid

Granite Geek: Take advantage of living on the edge of the grid

High schools: Concord softball falls on Senior Day; Stark, Brady baseball win on Memorial Day

High schools: Concord softball falls on Senior Day; Stark, Brady baseball win on Memorial Day

High schools: Final regular season track and tennis results; plus weekend baseball, softball and lacrosse

High schools: Final regular season track and tennis results; plus weekend baseball, softball and lacrosse Girls’ lacrosse: Bow bounces back with 13-3 win over Bishop Brady

Girls’ lacrosse: Bow bounces back with 13-3 win over Bishop Brady High schools: John Stark’s Philibotte pitches shutout, hits game-winning RBI in 1-0 win, plus more results from Wednesday

High schools: John Stark’s Philibotte pitches shutout, hits game-winning RBI in 1-0 win, plus more results from Wednesday High schools: Freitas 1-hitter leads Hopkinton softball to shutout; Tuesday’s baseball, lax, tennis and track results

High schools: Freitas 1-hitter leads Hopkinton softball to shutout; Tuesday’s baseball, lax, tennis and track results Concord became a Housing Champion. Now, state lawmakers could eliminate the funding.

Concord became a Housing Champion. Now, state lawmakers could eliminate the funding. ‘A wild accusation’: House votes to nix Child Advocate after Rep. suggests legislative interference

‘A wild accusation’: House votes to nix Child Advocate after Rep. suggests legislative interference  Town elections offer preview of citizenship voting rules being considered nationwide

Town elections offer preview of citizenship voting rules being considered nationwide Young Professional of the Month Katie Duncan shares about creativity, community, connection

Young Professional of the Month Katie Duncan shares about creativity, community, connection Tiny Tapestry sale at Red River Theaters raising money for Concord Coalition to End Homelessness

Tiny Tapestry sale at Red River Theaters raising money for Concord Coalition to End Homelessness