Latest News

Opinion: Learning from landscapes

Opinion: Learning from landscapes

Opinion: ‘This being human is a guest house’

Opinion: ‘This being human is a guest house’

With new plan for multi-language learners, Concord School District shifts support for New American students

Every time Leanna Kenza laces up her sneakers and steps on the track, it gives her reprieve from the day-to-day drama of eighth grade and the chance to find a new friend.While most Rundlett Middle School parents were enrolling their kids in sports in...

Skepticism turns to enthusiasm: Concord Police welcome new social worker

One of Nicole Petrin’s first cases in her new role as the Concord Police Department’s social worker drew frequent calls demanding officers’ attention.A senior woman with disabilities would often be wandering downtown. Chronically food insecure, she...

Most Read

With Concord down to one movie theater, is there a future to cinema-going?

With Concord down to one movie theater, is there a future to cinema-going?

“It’s beautiful” – Eight people experiencing homelessness to move into Pleasant Street apartments

“It’s beautiful” – Eight people experiencing homelessness to move into Pleasant Street apartments

No deal. Laconia buyer misses deadline, state is out $21.5 million.

No deal. Laconia buyer misses deadline, state is out $21.5 million.

Quickly extinguished fire leaves Concord man in critical condition

Quickly extinguished fire leaves Concord man in critical condition

Concord police ask for help in identifying person of interest in incidents of cars being keyed during Republican Party event

Concord police ask for help in identifying person of interest in incidents of cars being keyed during Republican Party event

Update: Victim identified in Lantern Lane fire in Concord

Update: Victim identified in Lantern Lane fire in Concord

Editors Picks

What’s in a name? Ask an Epsom Yeaton.

What’s in a name? Ask an Epsom Yeaton.

Downtown cobbler breathes life into tired shoes, the environmentally friendly way

Downtown cobbler breathes life into tired shoes, the environmentally friendly way

People of color incarcerated at higher rates in New Hampshire, but data is limited

People of color incarcerated at higher rates in New Hampshire, but data is limited

Former Concord firefighter sues city, claiming years of homophobic sexual harassment, retaliation

Former Concord firefighter sues city, claiming years of homophobic sexual harassment, retaliation

Sports

High schools: Bow track sweeps 4-team meet at Pembroke

Boys’ TrackBow 87, John Stark 57, Pembroke 43, Manchester West 34Key players: Bow – Kody McCranie (1st 100, 1st 200, 1st 400, 1st long jump), Wyatt Worcester (1st 1,600, 1st 3,200), Colin Atwell (1st high jump, 2nd 300 hurdles, 5th triple jump), Liam...

Opinion

Opinion: Summer camp registration: The only thing higher than the price is the anxiety

Brian Adams of Andover, Mass., is a UNH alumnus originally from Londonderry. He was previously a sketch comedy writing instructor and staff writer at ImprovBoston and a founding contributor to satirical online newspaper Recyculus. He is a father to...

Opinion: The truth of it

Opinion: The truth of it

Opinion: A bad idea for New Hampshire

Opinion: A bad idea for New Hampshire

Opinion: Medical Aid in Dying would have spared my father’s suffering

Opinion: Medical Aid in Dying would have spared my father’s suffering

Politics

Charities will not have to pay rent to casinos under new law

Deb Leahy can finally breathe easy, freed from the fluctuating rental fees each time her organization partners with a New Hampshire casino for donations.Thanks to a new law, casinos are now prohibited from imposing rent charges on charities for...

Sununu says he’ll support Trump even if he’s convicted

Sununu says he’ll support Trump even if he’s convicted

NH mayors want more help from state on homelessness prevention funds

NH mayors want more help from state on homelessness prevention funds

Two democrats with parallel views run for same State Senate seat

Two democrats with parallel views run for same State Senate seat

House passes bill removing exceptions to state voter ID law

House passes bill removing exceptions to state voter ID law

Arts & Life

Homeyer: Tips for planning a successful garden

Despite late snow storms that dumped deep snow over much of New England, spring is right around the corner. Let’s take a look at some keys to a successful year in the vegetable garden.Don’t bite off more than you can chew. Yes, I grow about 40 tomato...

From the farm: The Cow Spa is open

From the farm: The Cow Spa is open

Obituaries

Charles E. Lavalley Jr.

Charles E. Lavalley Jr.

Charles E. Lavalley, Jr. Allenstown, NH - Charles E. Lavalley, Jr, 95, passed away on Thursday, April 18, 2024 following a period of declining health. He was born on June 19, 1928 in Philadelphia, PA to the late Charles E. and Mary R. (B... remainder of obit for Charles E. Lavalley Jr.

Clyde R.W. Garrigan

Clyde R.W. Garrigan

Concord, NH - Clyde Richard Wendell Garrigan, of Concord, NH passed away on Sunday, April 21, 2024. He was born on June 3, 1953 in Brooklyn, NY to Patrick and Barbara Garrigan. He was raised in Valley Stream, NY and graduated from Valle... remainder of obit for Clyde R.W. Garrigan

Joanna M. Cloe

Joanna M. Cloe

formerly of Pembroke, NH - Joanna Mary (Cavanagh) Cloe, 79, passed away in Florida April 17th after a short illness. She was formerly a longtime resident of Pembroke, NH and member of St. John the Baptist Church. She was born in Bat... remainder of obit for Joanna M. Cloe

Rita A. French

Rita A. French

Contoocook, NH - Rita A. French, age 98, of Park Ave, passed away peacefully on Monday, April 22, 2024 at her home. She was born in Barton, VT one of 7 Children to the late Samuel and Myra (Leonard) Paul. Rita worked at Concord Hos... remainder of obit for Rita A. French

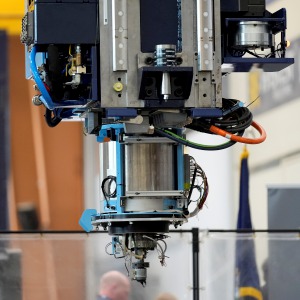

The world’s largest 3D printer is at a university in Maine. It just unveiled an even bigger one

The world’s largest 3D printer is at a university in Maine. It just unveiled an even bigger one

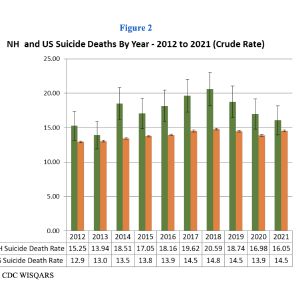

Suicide rates in New Hampshire declining since 2018, report says

Suicide rates in New Hampshire declining since 2018, report says

Opinion: The Concord School Board can restore trust with residents

Opinion: The Concord School Board can restore trust with residents

Concord man charged felony criminal mischief following vandalism outside NH GOP event

Concord man charged felony criminal mischief following vandalism outside NH GOP event

Getaway driver in Winnipesaukee hit-and-run arrested

Getaway driver in Winnipesaukee hit-and-run arrested

Head of NH Port Authority placed on administrative leave

Head of NH Port Authority placed on administrative leave

As UNH hosts rally against Gaza war, lawmakers weigh campus free speech protections

As UNH hosts rally against Gaza war, lawmakers weigh campus free speech protections

High schools: Concord girls’ lax picks up first win, Tide softball handed first loss in pitchers’ duel

High schools: Concord girls’ lax picks up first win, Tide softball handed first loss in pitchers’ duel High schools: Coe-Brown softball wins 5th straight, Concord’s McDonald pitches first varsity win, Tide’s Doherty scores 100th career point

High schools: Coe-Brown softball wins 5th straight, Concord’s McDonald pitches first varsity win, Tide’s Doherty scores 100th career point High schools: Bow’s Kelly lifts Falcon softball to victory in walk-off, more Monday results, plus Saturday’s track meets

High schools: Bow’s Kelly lifts Falcon softball to victory in walk-off, more Monday results, plus Saturday’s track meets Patriots’ draft approach likely to be different in post-Belichick era

Patriots’ draft approach likely to be different in post-Belichick era Opinion: Public school standards overhaul will impact every facet of public education in NH

Opinion: Public school standards overhaul will impact every facet of public education in NH Celebrate agriculture, education, and community at the NH Farm, Forest, and Garden Expo

Celebrate agriculture, education, and community at the NH Farm, Forest, and Garden Expo Community Players of Concord present newest adaptation of Pride and Prejudice

Community Players of Concord present newest adaptation of Pride and Prejudice Concord Monitor editor Mike Pride’s final book explores the lives, works of Northern New England poets

Concord Monitor editor Mike Pride’s final book explores the lives, works of Northern New England poets