Mark Fernald: Why your property taxes are so high

| Published: 07-20-2018 4:46 PM |

New Hampshire has the second-highest property taxes per capita in the nation (behind New Jersey). The citizens of New Hampshire pay a higher percentage of income in property tax (5.6 percent) than any other state.

The myth in New Hampshire is that we run the state on “sin taxes”: cigarettes, alcohol and gambling. The reality is that more than two-thirds of all state and local taxes in New Hampshire are property taxes.

(See “Sources of Revenue” chart, Page D3.)

Relying so heavily on the property tax means that, on average, the lowest-income people pay the highest percentage of income in state and local tax, while the people with the most income pay the lowest percentage of income in tax.

(See “Distribution of Tax Burden” chart, Page D3).

It is a system that taxes the elderly out of their homes. It is a system that makes homes unaffordable to young families because the monthly property tax bill often exceeds the mortgage payment. And it is a system that, for the wealthy, is the next best thing to Monaco.

Since New Hampshire “solved” the education funding crisis in 1999, the total state and local property tax bill in New Hampshire, adjusted for inflation, has increased by 58 percent, far exceeding the growth in the state’s economy (37 percent), and outstripping the ability of most people to pay.

Meanwhile, the state’s general fund revenue, adjusted for inflation, has declined.

Article continues after...

Yesterday's Most Read Articles

By all appearances, Canadians are leery of coming to NH

By all appearances, Canadians are leery of coming to NH

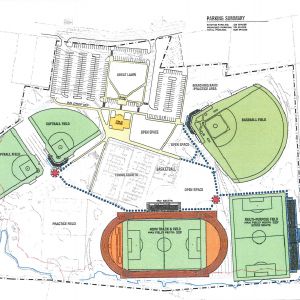

Plans advance on $27M Memorial Field project

Plans advance on $27M Memorial Field project

“A dream come true” – Family opens housing for adults with disabilities in Concord

“A dream come true” – Family opens housing for adults with disabilities in Concord

Memorial Day events in the Concord area

Memorial Day events in the Concord area

Giving life back to board sports: Back Alley Boards upcycles boards into art

Giving life back to board sports: Back Alley Boards upcycles boards into art

‘I thought we had some more time’ – Coping with the murder-suicide of a young Pembroke mother and son

‘I thought we had some more time’ – Coping with the murder-suicide of a young Pembroke mother and son

(See “Property Tax vs. General Fund Revenue” chart, this page).

The decline in the state’s revenue is the result of a change in ideology. The traditional “pledge” against any income or sales tax has been replaced with a mania for tax cuts, and a “pledge” against any new tax, any increase in tax rates, any new revenue, period.

We have been told that tax cuts are good for the state budget because revenue will grow. The “Property Tax vs. General Fund Revenue” chart shows that is just not so.

State revenue has declined because taxes were cut: the estate tax and inheritance tax were eliminated; the business profits tax and business enterprise tax were cut; and various tax breaks were written into the business taxes and the interest and dividends tax. In addition, some taxes, such as the cigarette tax and telephone tax, have not grown with the economy.

As revenue declined, the Legislature compensated by downshifting state obligations onto property taxpayers. The state stopped contributing to the cost of the retirement system for municipal and school employees; revenue sharing was slashed; school building aid was eliminated for new projects; and state aid to public schools has declined after adjusting for inflation.

At the same time, the Legislature has underfunded state obligations. Adjusted for inflation and population growth, state funding for our university system is 35 percent less than what it was in 1988.

(See “UNH Funding” chart, this page.)

Underfunding of our mental health system has caused people with mental health crises to pile up in our emergency rooms because there are no available beds in our mental health system. Opioid treatment centers are threatening to close for lack of funding. Disabled people are on a wait list for services.

Over the past 30 years, New Hampshire’s gas tax revenue, adjusted for inflation, has been cut in half.

(See “Gas Tax Revenue” chart, this page.)

The Department of Transportation now reports that more than a quarter of state-owned roads are in poor or very poor condition. As gas tax revenue has lagged, the distribution of state highway funds to cities and towns has not kept pace with inflation – putting more pressure on the property tax.

For New Hampshire to succeed, we need to be a state that offers affordable college to our talented high school seniors; that offers affordable housing to young families; that funds infrastructure and critical services; and that taxes its citizens fairly. In each of these areas, we have been moving in the wrong direction.

New Hampshire has a revenue problem. We get too much of our revenue from the property tax. We don’t have enough revenue to properly fund higher education infrastructure, and the safety net.

Here’s how we reverse these negative trends.

First, educate voters. These charts are a start.

Second, stop making the problem worse. Business tax cuts that are slated for 2019 and beyond should be repealed.

Third, get rid of the “pledge.” It is nothing more than a pledge to keep increasing your property taxes.

Fourth, learn what our options are. With another school funding crisis on the horizon, it’s time for a thorough review of our tax system.

We are faced with a stark choice. Vote for those who take the “pledge,” and watch state revenue decline and property taxes go up. Or consider alternatives to the property tax.

The New Hampshire Constitution tells us that government is instituted for “the general good.” It also tells us that everyone should pay “his share” of the cost of government. We can’t live up to our constitution with our current tax system.

(Mark Fernald is a former state senator and was the 2002 Democratic nominee for governor. He is currently a candidate for state Senate in District 9. He can be reached at mark@markfernald.com.)

]]>

Opinion: Unfair taxes, unfair schools: The New Hampshire way

Opinion: Unfair taxes, unfair schools: The New Hampshire way Opinion: In the fight to stop sexual violence, can polio hold the solutions?

Opinion: In the fight to stop sexual violence, can polio hold the solutions? Opinion: Where are the permanent solutions for a more stable budget?

Opinion: Where are the permanent solutions for a more stable budget? Opinion: My memories of Vietnam 50 years later

Opinion: My memories of Vietnam 50 years later